The US jobs report showed that Non-Farm Payrolls increased by 206K, surpassing the 190K estimate. However, the report’s details were not as positive as expected. Revisions to the prior two months showed a decrease of -111K, offsetting the growth seen this month. The unemployment rate rose to 4.1%, the highest since November 2021. Average hourly earnings YoY were at 3.9%, the lowest level since June 2021.

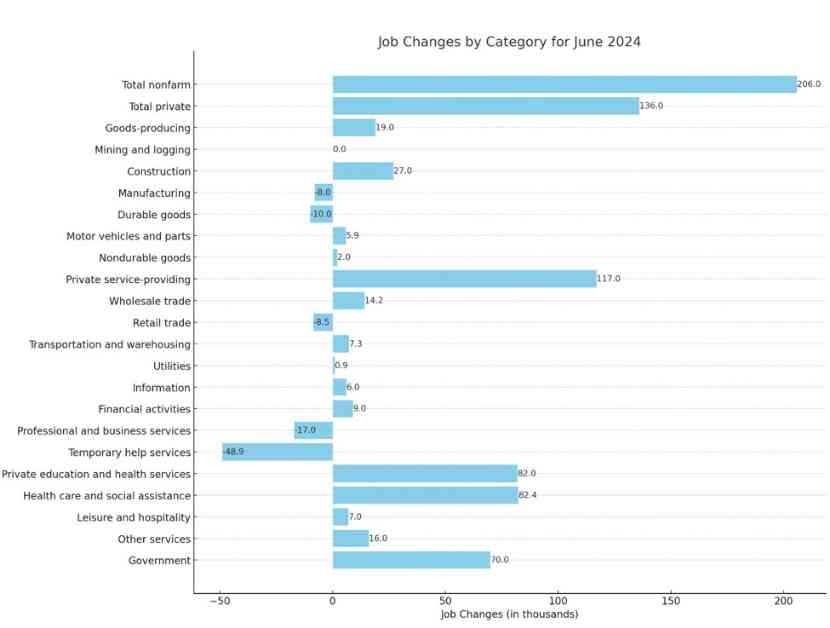

The gain in Non-Farm Payroll was mainly driven by a 70K increase in government jobs, with private education and health adding 82K. Temporary help saw a decrease of -48K, indicating a slowdown in the job market. Professional and business services fell by -17K, while the leisure and hospitality sector, typically a strong job creator, only saw a rise of 7K.

Initially, the forex market reacted with the dollar strengthening, but these gains were short-lived as yields also decreased. The USD ended the day as the second weakest major currency, behind the CAD. The largest declines were against the GBP, CHF, and NZD. In the US debt market, yields moved lower, with expectations for rate cuts in September and beyond increasing.

Looking at the yield curve, there were decreases across the board, with the 2-year yield at 4.605%, 5-year yield at 4.226%, 10-year yield at 4.278%, and 30-year yield at 4.475%. Throughout the trading week, yields continued to decline, with the 2-year, 5-year, 10-year, and 30-year yields all down significantly.

The decrease in yields helped drive stock prices higher, with the NASDAQ index reaching record levels each day of the holiday-shortened week. The Dow Industrial Average rose by 0.17%, the S&P index by 0.55%, and the NASDAQ index by 3.5%, marking its best week since April 22.

Despite the overall positive performance of broader stock indices, bitcoin experienced a significant drop of nearly $6000, currently at -$56,718. Crude oil prices saw an increase of $1.62 or 1.99%, despite a slight decrease of $0.72 or -0.86% today.