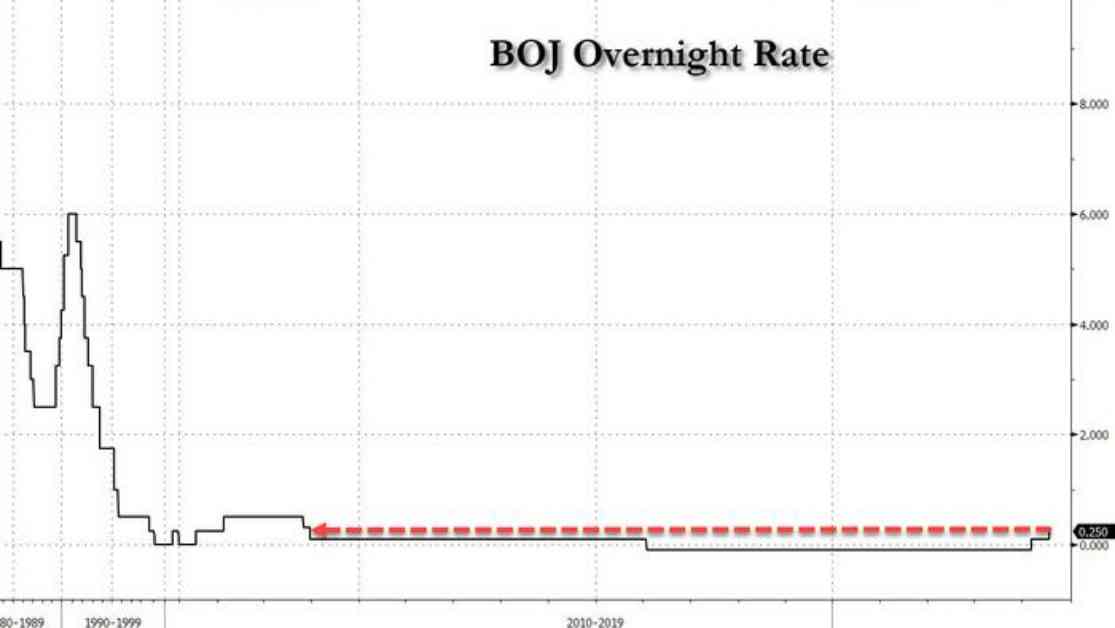

The Bank of Japan made a surprising decision to raise its benchmark interest rate to 0.25% and announced plans to reduce its monthly bond purchases by half. This move is an attempt to normalize its monetary policy, but it comes at a time when Japan’s economy is struggling, inflation is low, and wage growth is slowing down.

The decision to raise the interest rate to “around 0.25 per cent” was made by a majority of 7-2, marking the highest level since the global financial crisis in 2008. The Bank of Japan also announced that it would decrease its monthly bond-buying program from ¥6tn to about ¥3tn by the spring of 2026. This reduction will happen gradually, with monthly bond purchases being cut by ¥400 billion every quarter.

While some experts view this decision as a hawkish move, others believe that the quantitative tightening is less than expected. The market has been anticipating a more aggressive approach to reducing bond purchases. The yen strengthened by more than 1% following the decision, causing the USDJPY to fall below 150 against the dollar.

The decision to raise interest rates comes after pressure from senior government officials to unwind the ultra-loose monetary policy and address the yen’s decline. Despite some positive economic indicators, such as core inflation exceeding the 2% target for 27 consecutive months, Japan’s economy contracted in the first quarter of the year.

Economists are divided on the impact of the rate hike, with some criticizing the move to counter the weak yen without considering the weak economic data. The Bank of Japan’s forecast for consumer price inflation has been revised upward to 2.1% for the year ending in March 2026.

Moody’s Analytics senior economist Stefan Angrick believes that the Bank of Japan is hiking rates into a weak economy and that the next rate increase may not come until December. He warns that the central bank needs to be clear about its changing rules and the potential consequences of its actions.

The decision to raise interest rates has already boosted the yen against the dollar, with expectations of further rate hikes contributing to this trend. However, hedge funds may still have significant short positions in the Japanese currency, which could lead to more volatility in the foreign exchange market.

In conclusion, the Bank of Japan’s decision to raise interest rates has sparked debate among economists and market analysts. While some view it as a necessary step to address the weakening yen, others are concerned about the impact on Japan’s fragile economy. The future trajectory of the yen and the effectiveness of the Bank of Japan’s policies remain uncertain.