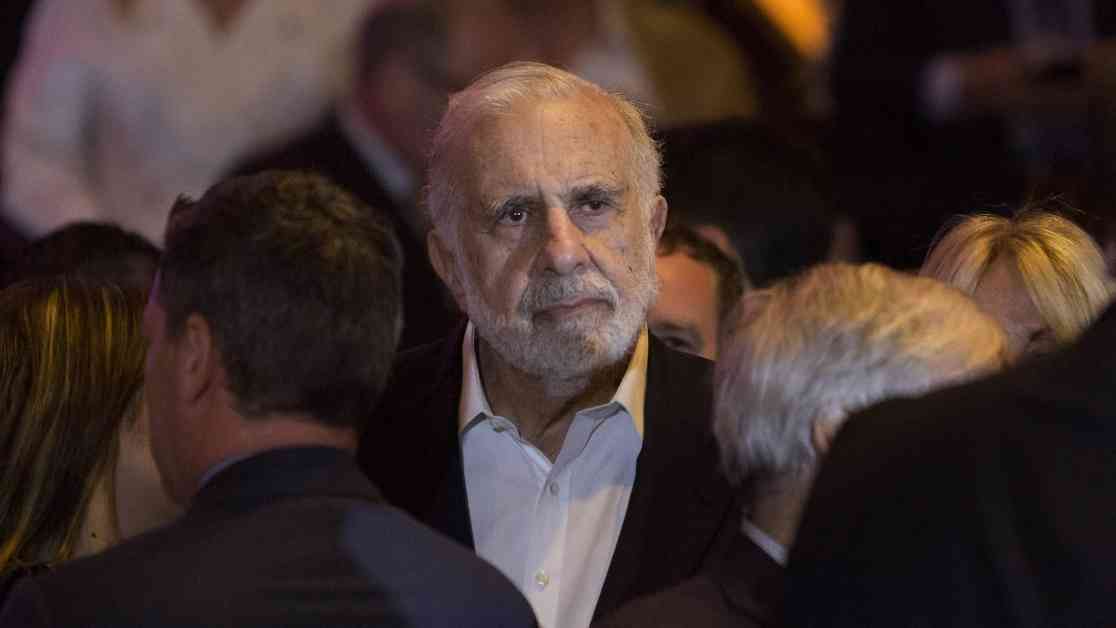

Billionaire activist investor Carl Icahn has found himself in hot water with the U.S. Securities and Exchange Commission (SEC) for allegedly hiding billions of dollars in loans backed by his Icahn Enterprises stock. The SEC announced on Monday that Icahn and his company have agreed to pay fines totaling $2 million to settle the charges.

Icahn, known for his aggressive approach to investing and corporate governance, has built a reputation as a formidable force in the financial world. However, his recent run-in with the SEC sheds light on a less savory aspect of his dealings – the failure to disclose significant personal margin loans secured against his Icahn Enterprises stock.

The SEC’s investigation revealed that Icahn had pledged anywhere from 51% to 82% of Icahn Enterprises’ outstanding shares to secure loans worth billions of dollars without informing shareholders or regulators. This lack of transparency raised concerns about potential conflicts of interest and the true financial health of Icahn Enterprises.

The SEC’s findings have led to a settlement in which Icahn and his company will pay fines of $500,000 and $1.5 million, respectively. While neither party admitted nor denied wrongdoing, the penalties serve as a reminder of the importance of full disclosure in the financial markets.

Background on Carl Icahn

Carl Icahn, 86, has been a prominent figure in the world of finance for decades. Known for his aggressive investment style and willingness to take on corporate giants, Icahn has made a name for himself as a corporate raider turned activist investor.

Born in Queens, New York, Icahn began his career as a stockbroker before founding his own investment firm, Icahn Enterprises, in 1968. Over the years, he has amassed a fortune through strategic investments in companies such as TWA, RJR Nabisco, and Apple.

Icahn’s reputation as a shrewd investor and dealmaker has earned him a place among the wealthiest individuals in the world. His net worth is estimated to be in the billions, making him one of the most influential figures in the financial industry.

The SEC Charges and Settlement

The SEC’s charges against Icahn and his company stem from their failure to disclose the extent of Icahn’s personal margin loans secured against Icahn Enterprises stock. According to the SEC, Icahn had borrowed as much as $5 billion using his IEP shares as collateral, without informing shareholders or regulators.

The SEC’s investigation found that Icahn had pledged a significant portion of IEP’s outstanding shares to secure these loans, raising questions about the potential impact on the company’s financial stability. The lack of disclosure was seen as a violation of federal securities laws, which require controlling shareholders to report any encumbrances on their stake.

In settling the charges, Icahn and his company agreed to pay fines totaling $2 million, but did not admit to any wrongdoing. The penalties serve as a reminder of the importance of transparency and disclosure in the financial markets, particularly for high-profile investors like Icahn.

Implications for Icahn and IEP

The SEC’s charges and the subsequent settlement have raised questions about the future of Icahn Enterprises and Carl Icahn’s reputation as an investor. The allegations of hiding billions in loans backed by IEP stock have cast a shadow over Icahn’s business dealings and could have long-lasting consequences for his investment firm.

Investors and analysts are closely watching how Icahn Enterprises’ stock will react to the news of the SEC charges. The company’s shares fell 6% following the announcement, reflecting concerns about the potential impact of the allegations on its financial performance.

Icahn’s response to the charges has been to downplay their significance and emphasize his commitment to operating the business for the benefit of unit holders. However, the lingering questions about the true extent of his personal borrowing and the implications for IEP’s financial stability are likely to linger for some time.

In the wake of the SEC charges, Icahn Enterprises has come under scrutiny from short seller Hindenburg Research, which has accused the company of not accurately valuing its holdings. The ongoing criticism from Hindenburg Research has added to the pressure on IEP’s stock price and raised doubts about the company’s financial practices.

Despite the challenges facing Icahn Enterprises, Icahn himself remains a formidable figure in the financial world. His track record of successful investments and bold dealmaking have earned him a reputation as one of the most influential investors of his generation.

Conclusion

The SEC charges against Carl Icahn and Icahn Enterprises for hiding billions in loans backed by IEP stock have raised questions about transparency and disclosure in the financial markets. The settlement reached between Icahn, his company, and the SEC underscores the importance of full disclosure for investors and regulators alike.

As one of the most prominent figures in the world of finance, Carl Icahn’s actions and business dealings are closely watched by investors, analysts, and regulators. The fallout from the SEC charges is likely to have far-reaching implications for Icahn Enterprises and its stakeholders, highlighting the need for greater transparency and accountability in the financial industry.