He defends a regional financing model in which if a CCAA lowers taxes, it receives less funds because that is because it needs less

It proposes to deflate the income tax rate up to 100,000 euros, especially at low rates, so that the people of Madrid pay less than with the PP

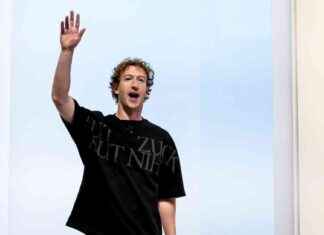

MADRID, 11 Dic. (EUROPA PRESS) –

The general secretary of the PSOE of Madrid and candidate to preside over the Community, Juan Lobato, proposes that the Basque Country apply the tax to great fortunes as it will be done in the rest of the Autonomous Communities. At least, he assures, as long as the regional financing system in which he proposes that there is fiscal co-responsibility is not modified, in such a way that if a region lowers taxes it receives less funds applying the principle that if it reduces taxation it is because it needs less.

The Madrid socialist leader made these statements during an interview with Europa Press, after it was published in various media that the PNV and the PSE are negotiating not to apply the tax to large fortunes in the Basque Country. A tax that is now being processed in the Senate and with which the Government intends to compensate for the low taxation in the Heritage tax that some PP autonomies such as Madrid or Andalusia have.

However, with the transfer of said tax to Euskadi, it could not be applied in this Autonomous Community, which already has a Wealth tax.

When asked about this question, the Madrid socialist leader defends that if the regional financing model is not going to be touched for the moment, so that there is more fiscal co-responsibility, the Basque Country should apply this tax.

In this sense, he explains that on this matter he has a “very defined and very clear” position: “I believe in the fiscal autonomy model of the Spanish Constitution, that is, I believe that each community must have the autonomy to decide what their taxes, for that there are regional elections and for that there is a margin of decision on regional taxes”.

But this question, he clarifies, must be “directly related and conditioned to the regional financing model”. And he gives the example of the municipalities for which this model already exists, in which each municipality decides what percentage it puts on the IBI, which can be between 0.4 and 1.1. That, he points out, is all the margin that mayors have to decide.

Thus, he points out that if the mayors decide to lower the IBI to a minimum, the city council obtains less financing from the State applying the principle of “if you decide to lower it to the minimum, you need less”, but if the municipality “decides to raise it, it also obtains more financing from the Condition”.

That, in his opinion, is the model that should be applied with the Autonomous Communities, that is, that they decide according to their fiscal autonomy, but if taxes are lowered, “especially for millionaires”, he considers that it will be that “they need less funds”. and in the regional financing model they should receive less funds.

As for the Basque Country, which is outside the regional financing model because it has its own tax system, Lobato points out that when negotiating the Economic Agreement and the Quota, this “fiscal co-responsibility model must also be present, with the safeguard that The Constitution lays it down, of course.”

According to Juan Lobato, who states that he has “studied, written, published and reflected for many years” on the question of regional financing, this approach is “the only thing that can give us coherence to the common tax and financing system, the only thing” .

In addition, he considers that this would give each CCAA the possibility of making their financing political decisions, that is, “of the fiscal and investment model, of social commitment and for the services and competences” that each region has.

However, the Basque Quota has just been negotiated and the reform of the regional financing model is years behind schedule. For this reason, he assures that “if the financing model is not going to be touched, the logical thing is that they would apply it too”, in reference to the tax on large fortunes in the Basque Country.

And in the opposite case, that is, that the regional financing model is linked to that “essential” fiscal co-responsibility in his opinion, then yes “let them decide if they apply or not, but just like the rest of the autonomous communities, for Madrid example”.

Having said this, Juan Lobato explains that the PSOE’s proposal for the community of Madrid is to eliminate the Heritage and Inheritance tax for all productive assets. “In other words, for all assets that a natural person has or that has companies, shares, homes, real estate assets that are renting, so that they do not pay a single euro of taxes, because it is already generating economic activity, jobs, it is already paying taxes for that way”, he specifies and exclaims: “how are we going to make him pay again for wealth or inheritance tax”.

On the contrary, it considers that “speculative assets, the billionaire who has shares in companies in offshore tax havens” must pay “and offers the alternative of transferring these funds to the Community of Madrid and generating employment and economic activity.

He also criticizes the fiscal model that the PP is applying in the region. In this regard, he points out that the ‘popular’ are dedicated to “making headlines” every week stating that they are going to lower taxes on “nephews in inheritances”, but in reality, he says, Ayuso’s tax model is to drop to 90 percent. percent of citizens between 0 and 11 euros. On the contrary, he points out, the 2 percent of the great fortunes have been forgiven 992 million.

For this reason, his party has presented in the region a “complete and serious” tax reform proposal in which he proposes to help those who are now suffering from inflation, who are “low, medium and upper-middle income” to lower taxes for 95 percent of Madrid residents who, he says, “will pay less taxes with our reform than with that of the PP.”

Of course, he points out that 5 percent of the great fortunes are asked for a greater contribution. “Anyone who earns more than 100,000 euros, which is slightly less than 5 percent, due to the progressivity of the taxes, will pay a little more,” he explains, but stresses that “everyone who earns less than 100,000 euros will pay less tax.”

His proposal includes an “intensified deflation for these incomes, with which they will see the taxes they pay in Madrid reduced by “much greater amounts than inflation has risen, especially low ones”. Therefore, he considers that the inflation effect is not only would be neutral, but would be positive.

Something that contrasts, he points out with the drop proposed by the PP, which would be applied in May of next year, despite the fact that inflation “has occurred this fall.” “God knows how we will be in May of next year,” exclaims Lobato who charges against “Ayuso’s populism.”

Regarding the possibility that the Government abolishes the 20 cents of gasoline bonus as of January 1, 2023, Lobato’s position is to go to a progressive model and gradually reduce this aid in a “staged” manner and “according to how energy prices are falling”.

However, he admits that the application is complex and it should be the Ministry and the Technical Commissions who decide the scheme. He argues that it is a very specific measure to alleviate the effect of inflation, but he does not believe that “incentivizing the use of hydrocarbons” makes sense.