The week ended on a soft note for US equities, with key events and releases to watch in the upcoming week. Gold saw a short-lived rally before falling $40. MUFG predicts that the BOJ may raise rates next month, putting pressure on the MOF to intervene. The Baker Hughes oil rig count decreased by 3 to 485, while European equities closed the week with a mixed performance. In the US, May existing home sales slightly exceeded expectations at 4.11m, and the June S&P Global flash services PMI came in at 55.1, surpassing the forecast of 53.7.

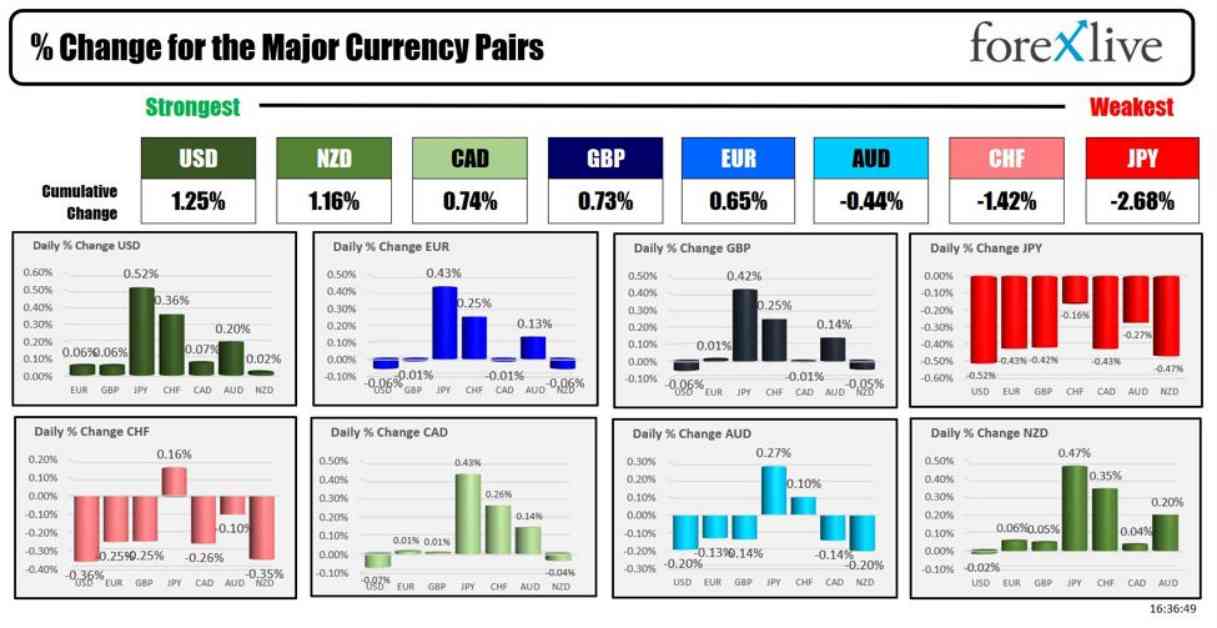

As the trading day kicked off on June 21, a technical analysis was conducted on the EURUSD, USDJPY, and GBPUSD pairs. In Canada, the May producer price index met estimates at 0.0%, and April retail sales rose by 0.7%, as anticipated. At the start of the North American session, the NZD emerged as the strongest currency, while the GBP lagged behind.

The USD showed strength against major currencies, with the JPY being the weakest. The greenback’s gains were supported by better-than-expected flash PMI data, which indicated a rise in the services index to 55.1 and manufacturing index to 51.7. The USDJPY pair reached its highest level since April, hitting 159.774. A move above 160.208 could propel the pair to levels not seen since 1990 and 1987. However, there is a risk of intervention by the BOJ, which attempted to influence the JPY higher but failed.

Despite the SNB cutting rates by 0.25% and the BOE keeping rates unchanged with a dovish statement, the USD outperformed the CHF and other major currencies. US stocks closed mixed for the day, with the Dow slightly up, the S&P down, and the Nasdaq lower. The Russell 2000 index saw a modest gain.

For the trading week, the S&P and Dow rose, while the Nasdaq remained virtually unchanged. Both the S&P and Nasdaq set new all-time high closes. In the US debt market, yields saw moderate increases across the board.

Overall, the USD showed strength against most major currencies, buoyed by positive economic data. The upcoming week will be crucial for traders, with various events and releases likely to impact the markets. Stay tuned for more updates and analysis. Thank you for your continued support, and have a great weekend.