The upcoming events for the week include various economic indicators from different countries. On Monday, we have the Bank of Japan releasing the Summary of Opinions and German IFO data. Tuesday will see the release of Canada’s CPI and US Consumer Confidence. Wednesday will bring Australia’s Monthly CPI. Thursday includes Japan’s Retail Sales, US Durable Goods Orders, US Final Q1 GDP, and US Jobless Claims. Finally, on Friday, Tokyo will release CPI data, the UK will release Final Q1 GDP, Canada will release GDP data, and the US will release PCE and University of Michigan Consumer Sentiment (final).

Starting with the Canadian CPI, the year-over-year measure is expected at 2.6% versus 2.7% prior, with the month-over-month measure expected at 0.3% versus 0.5% prior. The US Consumer Confidence is expected to be at 100 versus 102 prior. Australian Monthly CPI year-over-year is expected at 3.8% versus 3.6% prior. US Jobless Claims are expected at 236K versus 238K prior, with Continuing Claims at 1820K versus 1828K prior. Tokyo Core CPI year-over-year is expected at 2.0% versus 1.9% prior. US Headline PCE year-over-year is expected at 2.6% versus 2.7% prior.

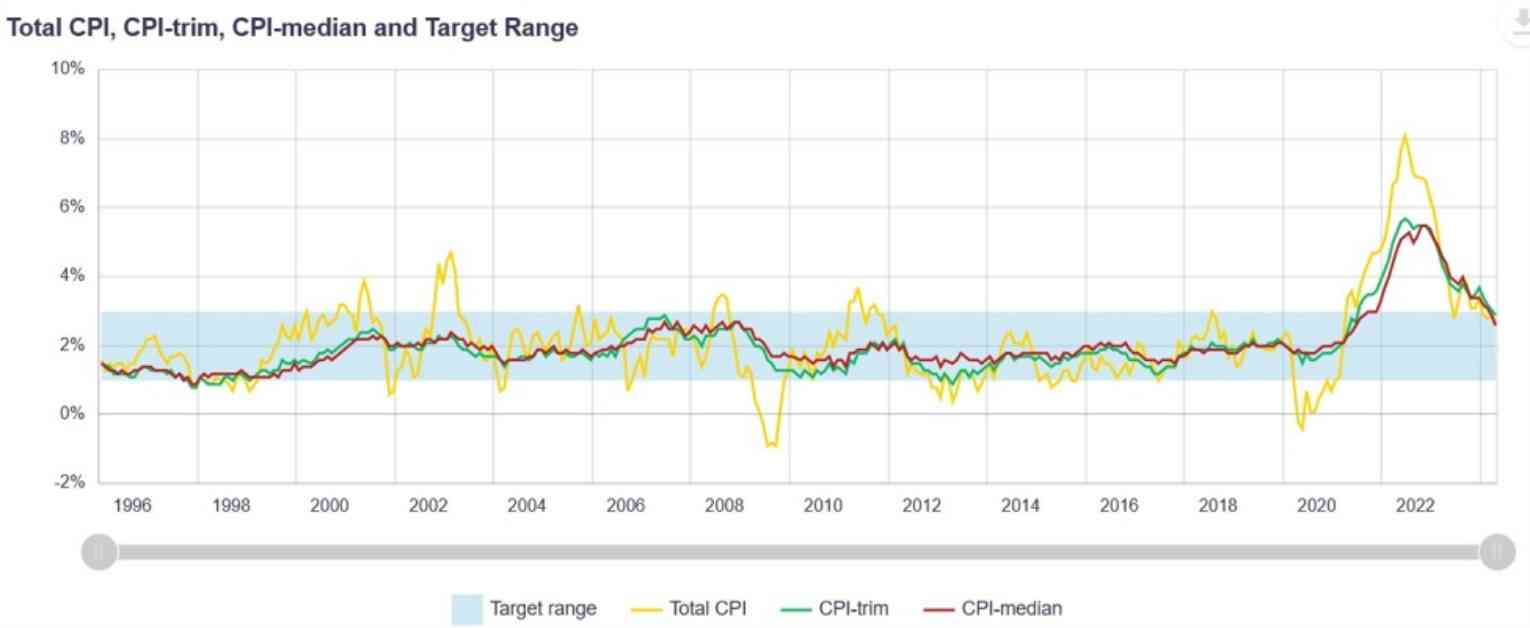

In Canada, the last report showed inflation measures falling back within the Bank of Canada’s target band of 1-3%, leading to the first rate cut. The market is anticipating another rate cut in July depending on this week’s CPI data. In the US, Consumer Confidence has been improving due to a strong labor market. The Present Situation Index will be important to watch, especially given recent misses in Jobless Claims.

The Australian Monthly CPI remains a focus as the Reserve Bank of Australia has kept a hawkish stance due to persistent inflation levels. Any deviation in inflation data could impact the chances of a rate hike. In Japan, inflation remains close to target levels, making a rate hike unlikely. The US Core PCE data is not expected to change the Fed’s current stance of waiting until September at least.

Overall, these economic indicators will provide insights into the state of different economies and central banks’ potential policy moves. It is essential for investors and traders to stay informed about these events to make well-informed decisions in the financial markets.