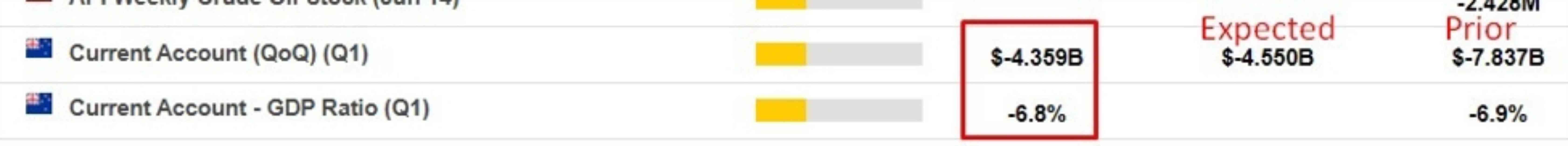

The recent data release showing New Zealand’s current account deficit narrowing to -4.359 billion NZD has had minimal impact on the NZD/USD trading pair, hovering around 0.6144. The current account is a crucial indicator of a country’s international financial interactions, encompassing not only the trade of goods and services but also earnings from foreign investments and payments on investments from abroad within New Zealand. Additionally, it includes transfers like overseas aid and remittances.

The current account is a component of a country’s balance of payments that tracks the flow of goods, services, investment income, and unilateral transfers (such as remittances and foreign aid) between the country and the rest of the world. It is further broken down into several categories:

1. Trade Balance: Calculated as the value of exported goods minus the value of imported goods.

2. Net Exports/Imports of Services: Covers services like tourism and software services.

3. Net Investment Income: Includes income from overseas assets, such as dividends and interest, minus payments made to foreign investors with assets in the country.

4. Unilateral Transfers: Involves transfers without a direct exchange, like remittances and foreign aid.

A positive current account balance indicates that a country is exporting more than it is importing, effectively lending to the rest of the world. Conversely, a negative balance signifies that a country is importing more than it is exporting, resulting in borrowing from other countries. Together with the capital and financial accounts, the current account forms a country’s balance of payments, offering a comprehensive view of its economic transactions with the world.

In analyzing New Zealand’s current account deficit narrowing to -4.359 billion NZD, it suggests improvements in the country’s trade and financial interactions with foreign entities. This narrowing deficit may indicate increased export competitiveness, reduced reliance on imports, or enhanced investment income from overseas assets. Such developments can contribute to a more stable economic outlook for New Zealand and potentially strengthen its position in the global market.

Furthermore, a narrowing current account deficit could lead to a boost in investor confidence, potentially attracting more foreign investments and fostering economic growth. It may also support the local currency, such as the New Zealand Dollar, by signaling a healthier economic environment and reducing external vulnerabilities.

Overall, while the impact of the current account deficit narrowing may not be immediately reflected in currency fluctuations, its long-term implications for New Zealand’s economy are worth monitoring. As the country continues to engage in international trade and investment activities, the current account will remain a key indicator of its financial health and global economic standing.