Today, the focus is on UK inflation as major currencies remain quiet. The US holiday will lead to a placeholder trading day, creating a bit of a lull in the middle of the week. The dollar is showing mixed results, while risk sentiment is positive in Wall Street. Tech shares are driving stocks higher, but there will be a pause today.

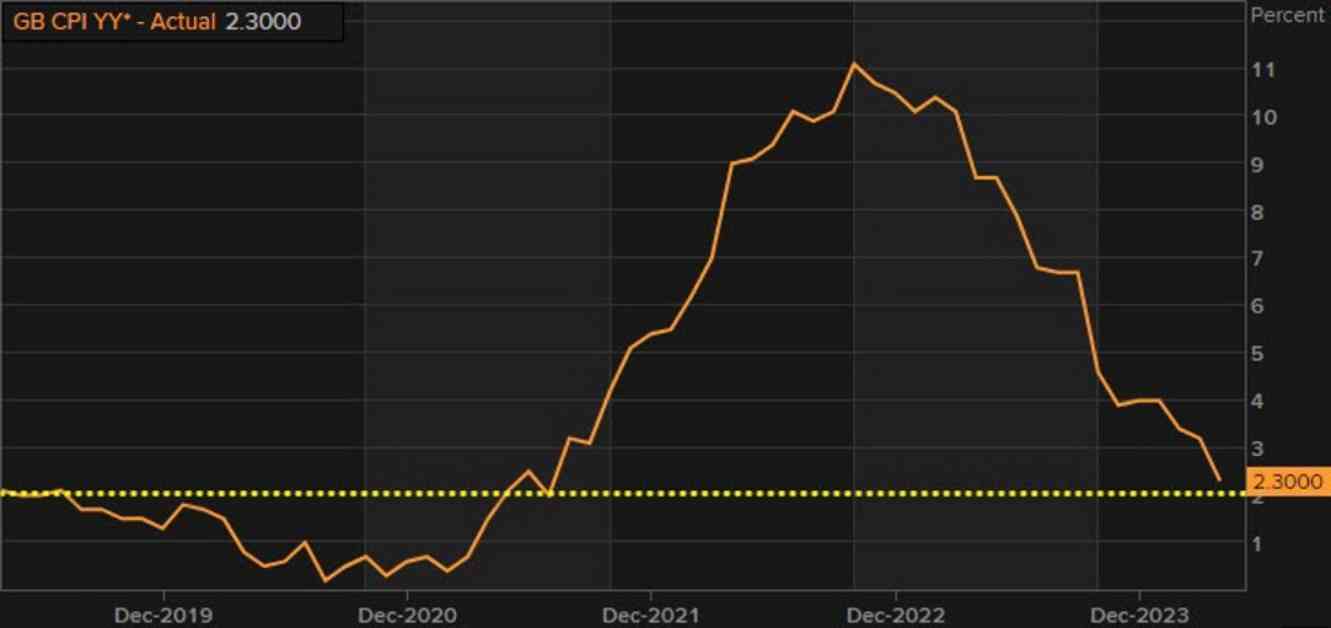

In European trading, UK inflation numbers for May will be released. Estimates suggest that headline annual inflation is expected to drop to 2.0%. However, it may not be enough to prompt the Bank of England to make any immediate moves, especially after the higher numbers in April.

Core annual inflation and services inflation are key factors that may delay rate cuts by the BOE. Traders are currently pricing in around 47 basis points of rate cuts for the year, with a 91% chance of a move in September. An August cut is only priced in at 44% at the moment.

The focus will be on sterling as the inflation data takes center stage. The upcoming schedule includes UK May CPI figures at 0600 GMT, Eurozone April current account balance at 0800 GMT, and US MBA mortgage applications for the week ending June 14 at 1100 GMT.

As we look ahead to the trading session, it’s important to stay informed and make wise decisions. Best of luck with your trading endeavors and remember to stay safe out there.