The UK Services PMI for June fell below expectations, with a reading of 52.9 compared to the prior 51.2. The Manufacturing PMI came in at 51.4, slightly higher than the expected 51.3, while the Composite PMI was 51.7, lower than the expected 53.1.

It seems that election jitters are starting to affect business activity in the UK, as the headline reading is at a 7-month low. However, there is a silver lining in the manufacturing sector, with conditions improving to a 23-month high.

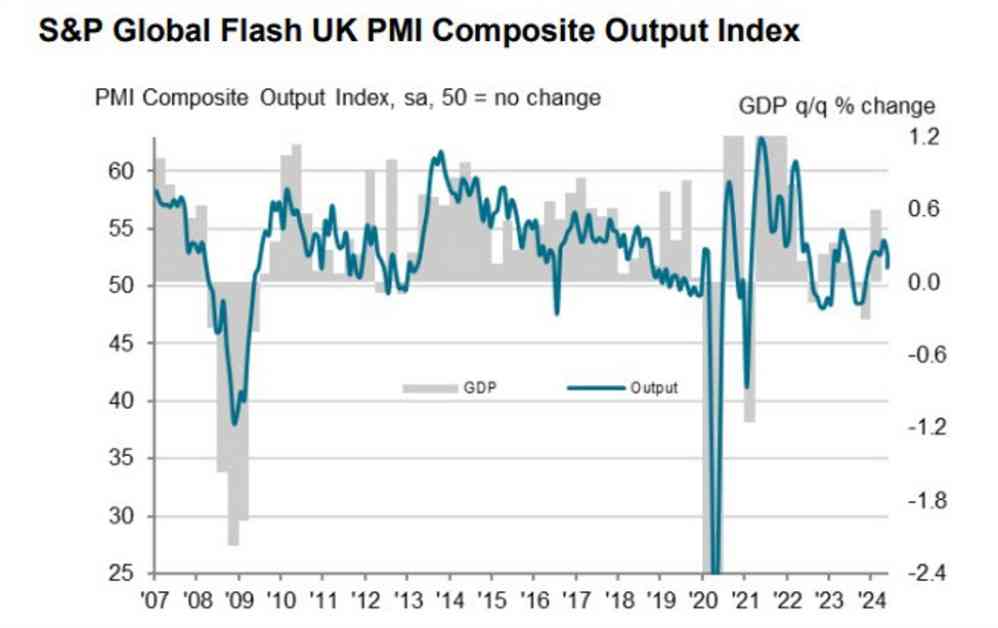

According to S&P Global, the slowdown in services activity may be partly due to a pause in client spending decisions ahead of the election period. The flash PMI survey data for June indicates a slowing pace of economic growth, with GDP growing at a sluggish quarterly rate of just over 0.1%.

Uncertainty surrounding the business environment before the general election has led to firms delaying decision-making until there is more clarity on various policies. Service sector inflation remains stubbornly persistent at 5.7%, posing a barrier to lower interest rates. However, it is expected to cool off in the coming months.

Companies are facing rising costs, especially in manufacturing where shipping costs are spiking, contributing to inflationary pressures on goods. Despite the temporary slowdown in economic growth, positive reactions from businesses to new government policies could help alleviate the underlying inflationary pressures above the Bank of England’s target.

In conclusion, while the current economic slowdown may be temporary, addressing inflationary pressures and uncertainties in the business environment will be crucial for future growth. Businesses will need to adapt to changing conditions and policies to navigate through these challenging times.