US Treasury yields continued to rise in the forex markets on July 1, with the NASDAQ index starting strong and closing at a record level. Former Fed Governor Clarida predicted one Fed rate cut in December, while Democrats are considering an early nomination for President Biden. ECB President Lagarde stated that it will take time to confirm if inflation is on track, while ECB’s Wunsch mentioned that the markets’ pricing on rate cuts is reasonable. Goldman Sachs highlighted the dollar’s strength against its challengers, and European indices closed the day with gains.

ECB’s Sinkus suggested the possibility of two more cuts in 2024, while the Atlanta Fed’s GDPNow growth estimate for Q2 was 1.7% versus the previous estimate of 2.2%. The decline in bonds was attributed to various factors, including French antitrust regulators preparing to charge Nvidia. Additionally, US construction spending for May was lower than expected at -0.1%, and the US May ISM manufacturing index and June S&P Global manufacturing PMI also fell short of expectations.

The USD gained momentum due to the rise in yields, leading to a steeper yield curve and increased market perception of potential growth under a Trump presidency. The 2-10 year treasury spread increased sharply, signaling a less negative yield curve. Former President Trump received relief from the Supreme Court, reducing the likelihood of prosecution and allowing more focus on the upcoming election. With the Democratic Party possibly keeping Biden as their candidate, there is speculation that Trump and the Republicans could win in November.

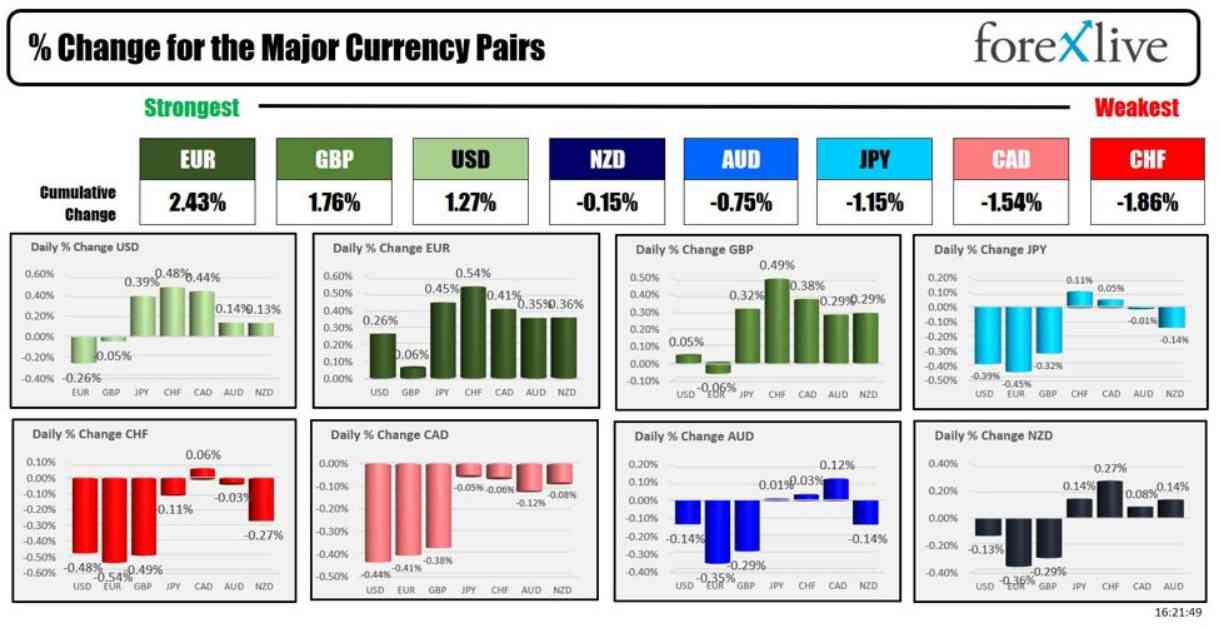

Yield curve changes for the day included the 2-year yield at 4.759%, up 4.0 basis points, and the 10-year yield at 4.469%, up 12.6 basis points. In the foreign exchange market, the USD was stronger against the CHF, CAD, and JPY, while the EUR and GBP led in strength to start the trading week. The USDJPY reached a new high for the year and its highest level since January 1987, indicating a bullish trend.

Despite the rise in yields, US economic data was weaker, with construction spending and the ISM manufacturing index falling below expectations. The upcoming US jobs report will be released after the July 4th holiday. The NASDAQ index closed at a new record high, while the S&P and Dow Industrial Average rose modestly. However, the small-cap Russell 2000 reacted negatively to the higher rates and steeper yield curve.

In other markets, crude oil, gold, silver, and Bitcoin all saw gains on July 1. The overall outlook for the US dollar remains positive, driven by rising Treasury yields and market perceptions of future economic growth. The impact of these factors on global markets will continue to be monitored closely in the coming days.