Nvidia’s Market Cap Dips, Exiting $3 Trillion Club

Nvidia, a major player in the tech industry, recently faced a significant setback as its stock plummeted by over 8% following its quarterly earnings report. This drop in share value resulted in the company losing approximately $273 billion in market capitalization, bringing its total worth down to $2.94 trillion. The sharp decline in Nvidia’s stock price also had a ripple effect on the broader market, with the S&P 500 index falling by 1.6% and the Nasdaq dropping by 2.8%.

The chipmaker’s stumble comes as a surprise to many, considering its status as the second most valuable U.S. tech company, only trailing behind Apple. Nvidia’s position in the industry has been solidified by its innovative products and strategic partnerships, particularly with tech giants like Microsoft. Despite its recent struggles, Nvidia has managed to maintain its standing as a key player in the ever-evolving tech landscape.

Throughout 2025, Nvidia has faced mounting challenges, including concerns from investors about export controls, tariffs, and advancements in artificial intelligence. The company’s growth trajectory has also slowed down, leading to a gradual erosion of its market value. However, it’s worth noting that Nvidia’s current market cap is still significantly higher than it was just two years ago, showcasing the company’s remarkable growth over a relatively short period.

In a recent earnings report, Nvidia exceeded analysts’ expectations, with its revenue soaring by 78% year-over-year to reach $39.33 billion. A significant portion of this revenue came from the company’s data center segment, which saw a remarkable 93% increase in revenue, primarily driven by its leading graphics processors for AI workloads. This strong performance indicates that Nvidia continues to innovate and deliver value to its customers, despite the challenges it faces in the market.

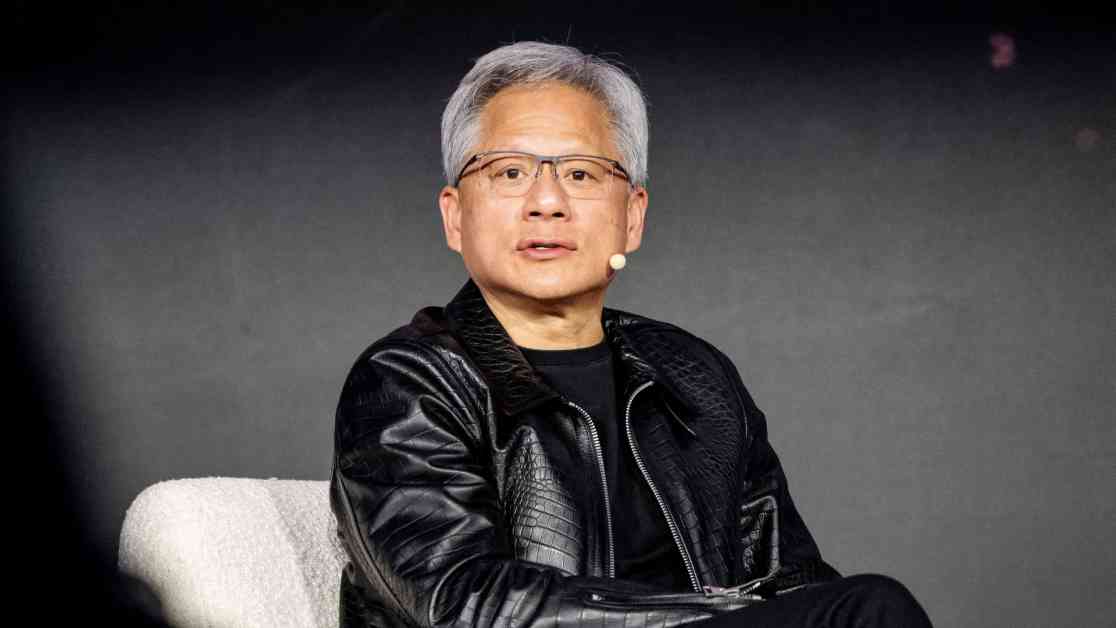

Looking ahead, Nvidia’s CEO, Jensen Huang, remains optimistic about the company’s future prospects. In a recent interview, Huang emphasized the growing demand for Nvidia’s chips, particularly in the realm of next-generation AI models. These advanced models require significantly more computing power to process complex tasks, creating a unique opportunity for Nvidia to capitalize on this emerging trend. By focusing on innovation and staying ahead of the curve, Nvidia aims to maintain its position as a market leader in the tech industry.

One of Nvidia’s key revenue streams comes from partnerships with major cloud service providers, including industry giants like Microsoft, Google, and Amazon. These partnerships play a crucial role in driving Nvidia’s data center revenue, highlighting the company’s strategic positioning within the tech ecosystem. As the demand for advanced computing solutions continues to rise, Nvidia is well-positioned to leverage its expertise and technological prowess to meet the evolving needs of its customers.

In conclusion, while Nvidia may have experienced a temporary setback in its stock performance, the company’s long-term prospects remain strong. By focusing on innovation, strategic partnerships, and customer-centric solutions, Nvidia is poised to overcome its current challenges and emerge stronger in the competitive tech landscape. As the industry continues to evolve, Nvidia’s ability to adapt and innovate will be critical in maintaining its position as a trailblazer in the world of technology.