Bitcoin recently experienced a drop in price, falling back to the 64000 level due to general market risk-off sentiment. Despite this, from a fundamental perspective, the data continues to show strong growth, decreasing inflation, and the possibility of the Fed cutting interest rates at least twice this year. It’s worth noting that Bitcoin saw a strong rally after a failed attempt to harm former US President Trump, as he has been a supporter of the cryptocurrency industry.

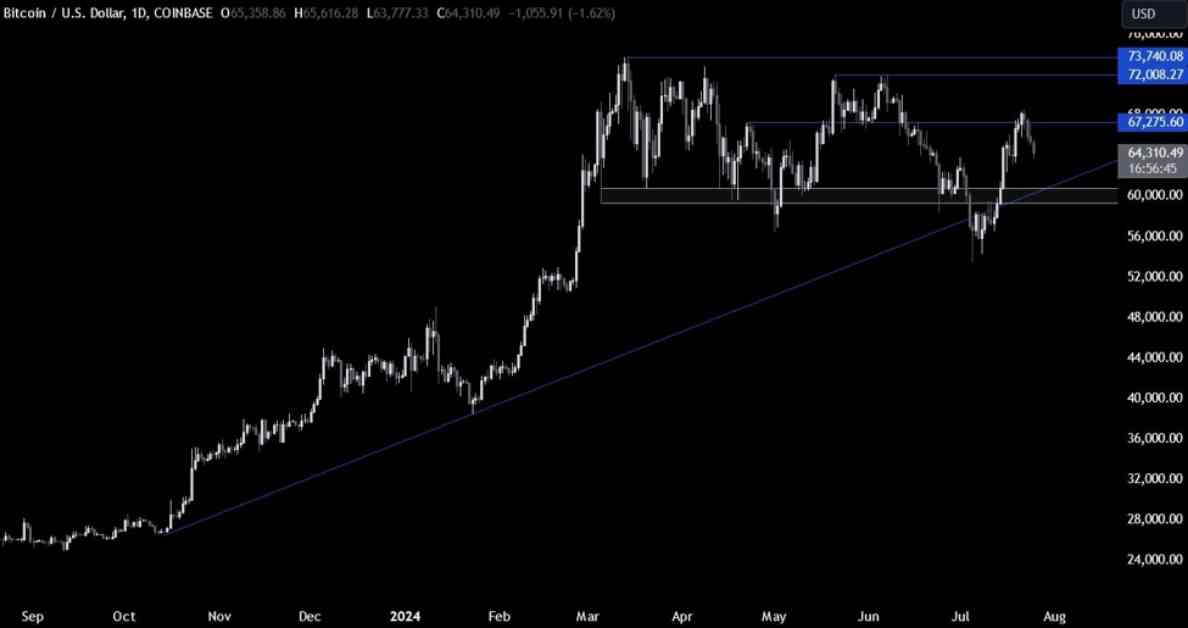

Two significant bearish factors from previous weeks have been resolved – the German government has sold all its Bitcoin holdings, and the old crypto exchange Mt. Gox has been repaying its former clients. Looking at the technical analysis, on the daily chart, Bitcoin failed to break above the key resistance at 67.275 and dropped to the 64000 level. Sellers may target the major trendline and support zone around 60000, but breaking strong levels on lower timeframes will be necessary first.

On the 4-hour chart, Bitcoin has pulled back to the 64000 support zone, where there is a confluence of the previous swing high, minor trendline, and the 38.2% Fibonacci retracement level. Buyers may step in at this point with a defined risk below the support zone to anticipate a rally to a new cycle high. Sellers, however, will be looking for a break lower towards 60000 to increase bearish momentum.

The 1-hour chart shows a clearer picture of the setup at the 64000 support level. Buyers are hoping for a bounce, while sellers are looking for a downside breakout. Keep an eye on the upcoming US Jobless Claims figures, US Q2 Advance GDP, and US PCE report for potential market-moving catalysts.

In conclusion, despite the recent price drop, Bitcoin’s fundamentals remain strong and there are various technical levels to watch for potential price movements. Stay informed and be prepared for volatility in the cryptocurrency market.