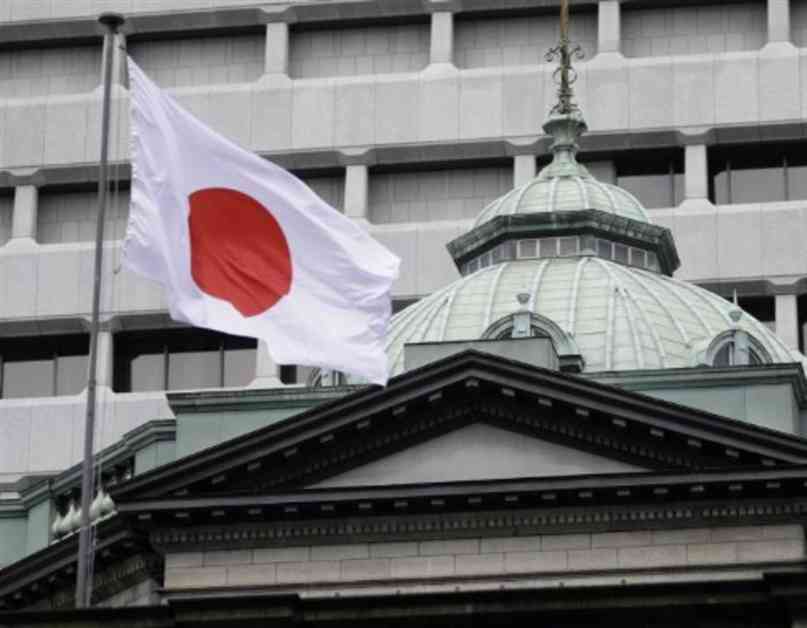

The Bank of Japan recently conducted a comprehensive review of its past policies, signaling a potential shift in its approach to inflation. According to Reuters, this review is expected to lay the groundwork for future rate hikes by emphasizing that Japan is prepared for higher interest rates. The Deputy Governor highlighted a significant change in Japan’s deflationary trend, suggesting a more optimistic outlook for the economy.

Despite the anticipation surrounding the review, there will be no modifications to the price goal or policy framework at this time. The full details of the review are set to be unveiled later this year, leaving analysts and investors eager to see how the central bank’s strategies may evolve.

Looking ahead, the Bank of Japan is scheduled to meet on July 30 and 31, with speculation mounting about the possibility of a 0.1% rate hike. While some market participants have priced in a 65% chance of an increase, investment firm BlackRock forecasts that the central bank will maintain its current rates during this upcoming meeting.

The upcoming meeting will be closely watched by market participants and economists alike, as any decisions made by the Bank of Japan could have far-reaching implications for the country’s economy and financial markets. As Japan continues to grapple with the economic fallout from the COVID-19 pandemic, the central bank’s policies will play a crucial role in shaping the recovery trajectory.

In light of the ongoing uncertainty surrounding the global economy, central banks around the world are facing mounting pressure to strike a delicate balance between supporting growth and managing inflationary pressures. The Bank of Japan’s review of its inflation strategy underscores the challenges policymakers are currently confronting as they navigate a rapidly evolving economic landscape.

As investors await further details on the Bank of Japan’s policy review, market dynamics are likely to be influenced by any hints or signals coming out of the central bank’s upcoming meeting. With the potential for increased volatility in financial markets, it is essential for investors to stay informed and closely monitor developments in Japan’s monetary policy decisions.

Overall, the Bank of Japan’s efforts to reassess its inflation strategy reflect a broader trend among central banks to adapt to changing economic conditions and ensure stability in the financial system. By carefully evaluating its policies and communicating its intentions clearly, the central bank aims to foster confidence and support sustainable economic growth in the months ahead.