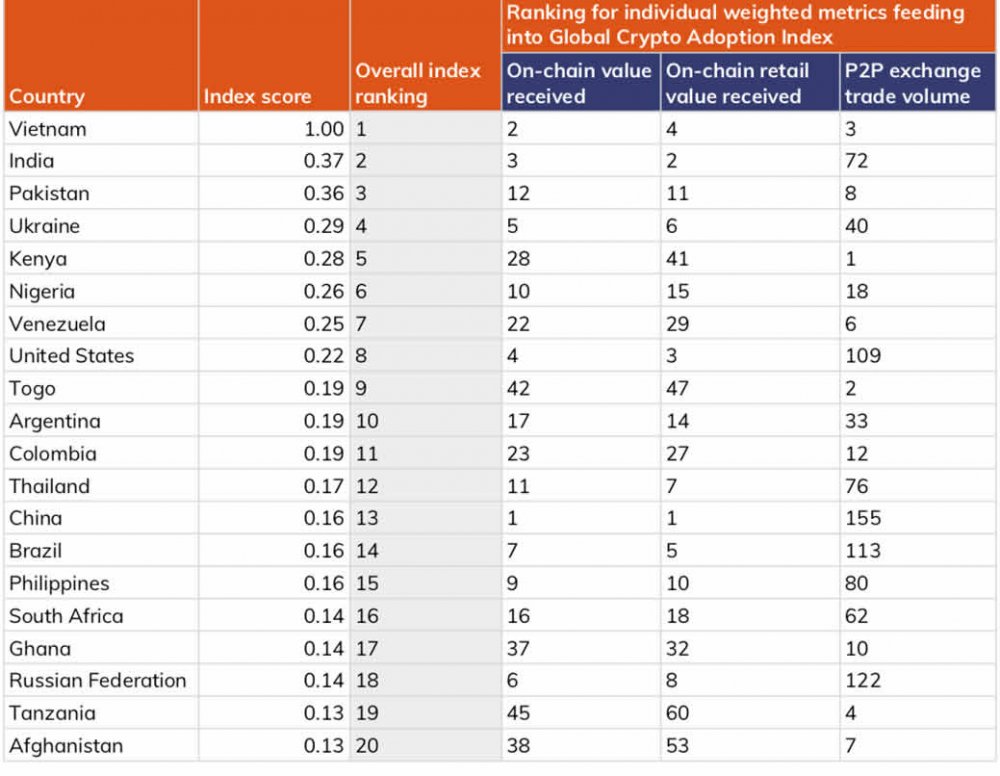

Third-world countries and emerging economies in the African and Asian continents are driving massive bitcoin adoption worldwide. Venezuela has the highest adoption rate, and troubled Afghanistan occupies the 20th position out of 154 countries ranked on the 2021 Global Cryptocurrency Adoption Index by Chainalysis.

Image Source: Chainalysis

The following deductions are drawn from data made available by Chainalysis:

- Cryptocurrency adoption has increased by 881% in one year with Vietnam, India, and Pakistan recording the highest adoption rate.

- 154 countries were ranked using indexes including trading volume, peer-to-peer exchange, and total cryptocurrencies activities on a scale of 0 to 1.

- Increased P2P trading volume, DeFi adoption, and tight capital control are factors driving high Bitcoin adoption rates in Venezuela, Kenya, Nigeria, Togo, and Afghanistan.

Cryptocurrency Adoption On The Increase Worldwide

According to a Binance report, the monumental year for cryptocurrency adoption is 2021, with emerging P2P driving the adoption rate. Based on data obtained from Chainalysis, Vietnam, India, and Pakistan top the list of countries with the highest cryptocurrency adoption rate. The most accurate crypto prediction site out there, cryptopredictions.com, forecasts that the crypto adoption rate will blossom by the end of 2021 and will jump up aggressively during 2022.

This is the second year Chainalysis will be releasing its global cryptocurrency Adoption index, which ranks 154 countries based on P2P trading volume in place of gross transaction volume, which would have seen countries like the US and China leading the trend with the highest institutional and professional cryptocurrency trading volume.

According to Chainalysis, the purpose of the data released on the global cryptocurrency adoption index is to measure cryptocurrency adoption by the masses and the volume of transactions and individual savings in cryptocurrencies by ordinary people. Therefore, the metrics used focused on measuring individual and collective wealth in cryptocurrency.

Based on the index, the top 20 countries with the highest cryptocurrency adoption rates include third-world countries and emerging economies. This can be attributed to a massive increase in P2P transaction volumes measured based on purchasing power parity and the internet-using population.

Conversely, P2P is the means of trading cryptocurrencies without the involvement of a central authority. Hence, many residents of emerging economies use P2P as a primary means of trading cryptocurrencies due to a lack of access to centralized exchanges as a result of unfavorable cryptocurrency policies.

Also, most residents are taking to cryptocurrencies to protect their savings from the heavy inflation as experienced by their fiat currencies, carry out faster business transactions, and bypass delays and heavy charges on remittances.

Vietnam Tops The Index With A Perfect 1.0 Rating

Kim Grauer, the director of research at Chanalysis, has attributed Vietnam’s ascension to the top of the index on a scale of 0 to 1 to its citizen’s penchant for gambling and investments in traditional Exchange Traded Funds (ETF) using cryptocurrencies.

In an interview with Matt Ahlborg, a P2P analyst, Matt says that Bitrefill records the highest transaction rates in Vietnam as more citizens have taken to making a living by buying or selling gift cards for cryptocurrencies.

Nigerians Shift To Cryptocurrencies For Commercial Activities

Unlike the Vietnamese, who rely heavily on cryptocurrencies for gambling, investment in traditional ETF, and gift card trading, Nigerians rely heavily on cryptocurrencies for commercial activities locally and internationally.

According to Grauer, massive international trade with China is carried out using cryptocurrencies in preference to the traditional dollar. This is due to the country’s unstable and fast declining Naira value against international currencies, lower transaction fees, and seamless payment process.

Capital Control Could Be Driving Cryptocurrency Adoption Index For Third-World And Emerging Economies

Boaz Sobrado, an analyst for a London-based fintech, noted that increased capital control or a higher emigration to immigration ratio is a major factor driving cryptocurrency adoption in emerging economies among the 20 countries topping the adoption index.

He cited Taliban-controlled Afghanistan’s 20th position ranking on the index to the country’s tight capital control, given that there’s a strict regulation against capital flight driving massive cryptocurrency adoption in the country.

Also, Afghan’s ranking can be attributed to the fact that the country ranks as one of the world’s poorest; hence, its 20th position ranking on the adoption index is based on the correction of its purchasing power parity and GDP.

The US And China Fell On The Global Cryptocurrency Adoption Index

The US and China could not maintain their sixth and fourth position on last year’s Chainalysis’s global cryptocurrency adoption index as they came tumbling down to 8th and 13th position on this year’s index. This slip down the index can be attributed to a serious drop in their P2P trading volume measured against the backdrop of their internet-using population, which fell from 16th to 109th for the US and 53rd to 155th for China.

The drop in ranking for the US can be due to increased professionalization and institutionalization of cryptocurrency-related trading. In contrast, China’s drop may be strongly related to the government’s heavy crackdown on cryptocurrency trading and bitcoin mining in its regions.

Limited Data From Sanctioned Nations

Overall, Boaz Sobrado noted that sanctioned countries don’t have adequate data on P2P markets. Hence, sanctioned nations like Cuba might have made the first 20 on the adoption index if P2P transactions are properly tracked and recorded.

Also, Matt Ahlborg noted for CNBC that it is impossible to have a perfect global cryptocurrency adoption index based on nations per capita, but the available adoption index remains the best bet for such measurements hoping that more data will be made available for accurate indexing of adoption rates.

Wrapping Up – The Future Of Cryptocurrency Adoption

Data gathered by Chainalysis shows that increased cryptocurrency transaction volume and massive growth of DeFi are the major factors driving cryptocurrency adoptions worldwide, with P2P leading the adoption rates for emerging markets. However, what is not certain is if unknown emerging market metrics will overtake known metrics like P2P trading volume, capital control, etc., as major drivers of cryptocurrency adoption worldwide.

In conclusion, cryptocurrency has experienced an increased adoption rate worldwide in the past year, with third-world countries and emerging economies driving the adoption rates.

This has proven that cryptocurrency is a truly global phenomenon that has taken the financial world by storm.