Tag: Economic indicators

US Housing Starts Plunge in Forexlive Americas FX News Wrap

US housing starts for the month of May came in lower than expected at 1.277 million, missing the 1.370 million forecast. Additionally, initial jobless...

US Dollar Strengthens as Treasury Yields Rise amid Weak Data

The US Dollar gained strength on Thursday as US Treasury yields rose, boosting the Dollar Index (DXY). Despite weak data, including a decrease in...

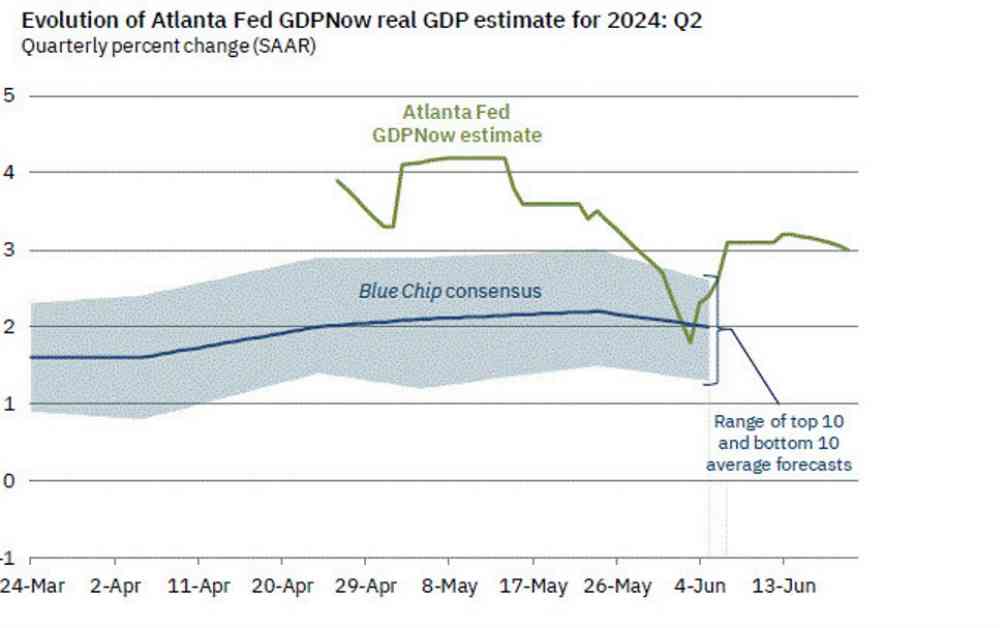

Atlanta Fed GDPNow Forecast for Q3 2021: 3.0% vs 3.1% Prior | Forex Update

We are approaching the end of the second quarter, and while we are still some time away from getting the official GDP numbers, the...

Bank of England to Keep Rates Unchanged and Approach Cautiously

The Bank of England is set to keep its policy rate unchanged for the seventh consecutive meeting on Thursday. Despite the recent increase in...

New Zealand Economy Shows Growth Despite Per Capita Decline

New Zealand's economy showed signs of growth in the first quarter of the year, with a GDP increase of 0.2% quarter-on-quarter, exceeding expectations of...

Gold Price Increases as Traders Expect Fed Rate Cuts

Gold prices saw minimal movement during the North American session due to low trading volume. This was attributed to the Juneteenth holiday. However, data...

Mexican Peso Faces Pressure Ahead of Retail Sales Data Release

The Mexican Peso experienced a slight decline against the US Dollar after making gains over the past five trading days. Currently, the USD/MXN pair...

BoJ Minutes: Concerns Over Weak Yen Impact on Inflation

The recent minutes from the Bank of Japan's meeting on April 25-26 have shed light on the concerns surrounding the impact of the weak...

Fed’s Williams Predicts Gradual Rate Cuts Amid Ongoing Disinflation – Market Update

New York Federal Reserve President John Williams recently discussed the state of the US economy in an interview with FOX Business. Williams expressed confidence...

Forex Market Update: Focus Shifts Across the Channel

The foreign exchange market traded without much movement on Tuesday as investors were focused on the potential timing of Federal Reserve rate cuts. Coming...