Billionaire hedge fund manager Paul Tudor Jones recently expressed his concerns about the current fiscal deficit of the U.S. government and the projected increase in spending by both presidential candidates. Jones warned that if the government does not address its spending issues soon, the bond market could react negatively after the election.

During an interview with CNBC’s Andrew Ross Sorkin, Jones emphasized the urgency of dealing with the country’s spending problems to avoid a financial crisis. He mentioned that excessive government spending could trigger a significant sell-off in the bond market, leading to higher interest rates. To prepare for this potential scenario, Jones stated that he would not invest in fixed income and would bet against the longer-dated bonds.

Jones raised the question of whether the United States would experience a “Minsky moment” after the election, referring to a sudden realization that the current fiscal policies are unsustainable. He pointed out that the federal deficit for the 2024 fiscal year surpassed $1.8 trillion, a worrying increase compared to the previous year.

The hedge fund manager criticized the rising budget deficits under the administrations of former President Donald Trump and President Joe Biden. He expressed skepticism about their ability to address the budget challenges effectively. Jones also highlighted his concerns about inflation, particularly in the event of a Trump victory.

In addition to his warnings, Jones suggested several ways for the government to improve its spending practices. This could involve allowing certain tax cuts to expire or implementing significant reductions in the federal workforce. He emphasized that these changes might be necessary to align government spending with revenue.

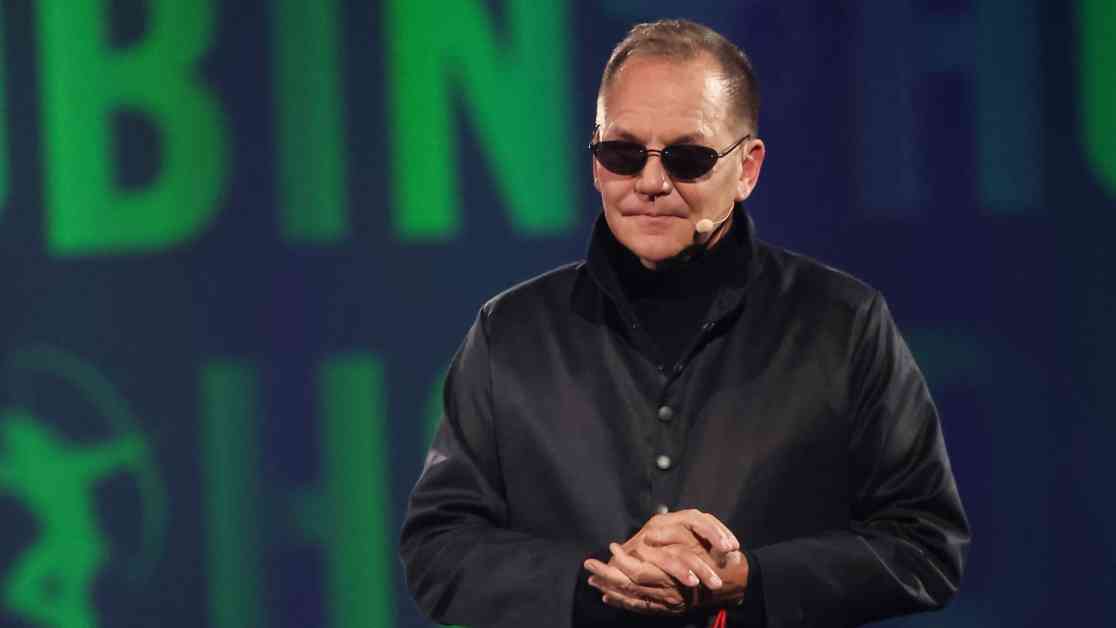

As the founder and chief investment officer of Tudor Investment Corporation, Jones has a long history of successful financial predictions. He gained recognition for foreseeing the stock market crash of 1987 and has since become a prominent figure in the hedge fund industry.

Overall, Jones’s remarks serve as a cautionary reminder of the importance of fiscal responsibility and prudent financial management at the government level. His insights highlight the potential risks associated with unchecked government spending and the need for proactive measures to address budget deficits and debt levels. By heeding these warnings and taking appropriate actions, policymakers can help safeguard the country’s economic stability and long-term prosperity.