Nvidia’s Historic $600 Billion Market Cap Plunge: A Game-Changer

Nvidia, a powerhouse in the tech industry, suffered a staggering blow on Monday, witnessing a jaw-dropping $600 billion loss in market cap. This unprecedented fall marks the largest single-day drop ever recorded for a U.S. company. The chipmaker’s stock price nosedived by a staggering 17%, closing at a sobering $118.58. This grim milestone is reminiscent of Nvidia’s darkest day in the market since March 16, 2020, during the early days of the Covid-19 pandemic. The repercussions were immediate, triggering a 3.1% decline in the tech-heavy Nasdaq after Nvidia had recently surpassed Apple to claim the title of the most valuable publicly traded company.

The catalyst behind this cataclysmic descent can be traced back to mounting concerns over heightened competition in the global AI landscape. Chinese artificial intelligence lab DeepSeek has emerged as a formidable contender, unveiling a game-changing large language model that was a product of a mere two months and less than $6 million investment. Their utilization of Nvidia’s H800s chips in this breakthrough development has sent shockwaves through the industry. Nvidia’s GPUs have traditionally reigned supreme in the U.S. market for AI data center chips, with tech behemoths like Alphabet, Meta, and Amazon heavily investing in these processors for training and running their AI models.

Experts at Cantor issued a report on Monday, expressing apprehensions about the impact of DeepSeek’s latest technology on compute demand and the subsequent fear of a decline in GPU spending. However, they believe that the evolution of AI will likely drive an insatiable appetite for more computing power, contradicting the prevailing sentiment. In fact, they advocate for purchasing Nvidia shares despite the tumultuous market conditions.

The aftermath of Nvidia’s market turmoil rippled through the tech sector, with other chipmakers like Broadcom witnessing a 17% plunge on Monday. This downturn dragged Broadcom’s market cap down by a hefty $200 billion. Data center companies reliant on Nvidia’s GPUs for their hardware sales also bore the brunt of the sell-off, with giants like Dell, Hewlett Packard Enterprise, and Super Micro Computer witnessing significant declines. Even Oracle, a linchpin in President Donald Trump’s AI agenda, fell by 14%.

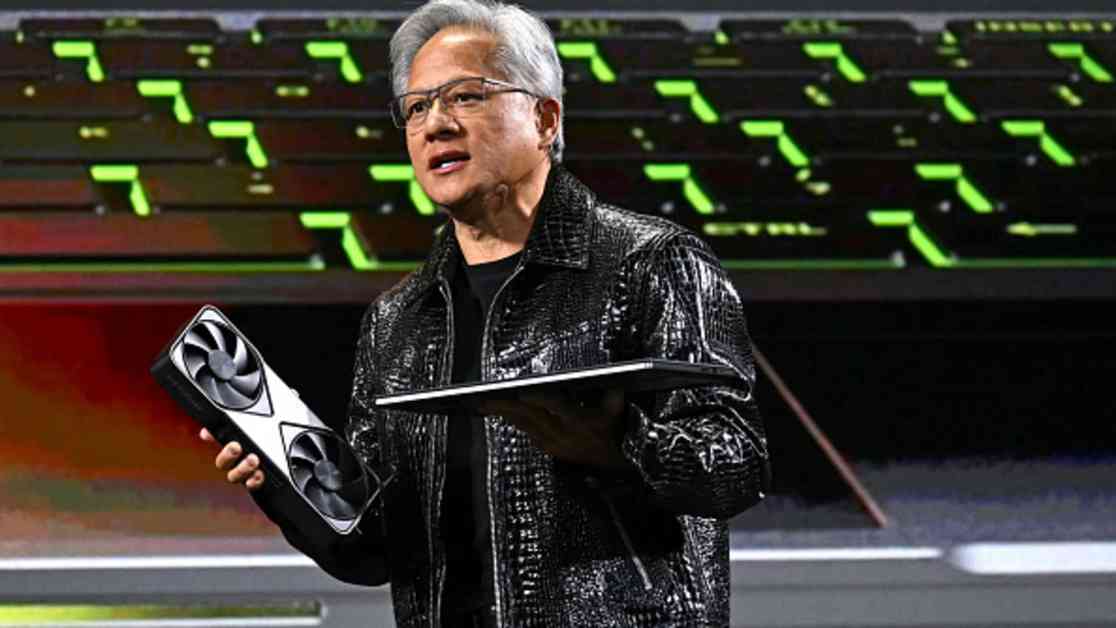

The repercussions of Nvidia’s unprecedented market plunge extend beyond the financial realm, impacting CEO Jensen Huang’s net worth to the tune of a staggering $21 billion decline. This seismic shift in fortunes relegated Huang to 17th place on Forbes’ real-time billionaires list, underscoring the personal toll of this market upheaval.

In a surprising twist, the fervor surrounding DeepSeek surged over the weekend, catapulting its app past OpenAI’s ChatGPT as the most-downloaded free app in the U.S. on Apple’s app store. This remarkable feat was accomplished despite recent restrictions on U.S. chip exports to China, underscoring the relentless pace of innovation in the AI landscape.

Venture capitalist David Sacks, a key player in Trump’s AI and crypto initiatives, lauded DeepSeek’s groundbreaking model as a testament to the fierce competitiveness of the AI race. His endorsement of Trump’s decision to revoke President Joe Biden’s recent executive order on AI safety underscores the high-stakes nature of this technological arms race.

As the dust settles, Nvidia finds itself grappling with a new reality as the third most valuable public company, trailing behind tech titans Apple and Microsoft. The aftershocks of this historic market plunge serve as a stark reminder of the volatility and unpredictability that define the ever-evolving tech landscape.