GBP/JPY Forecast: Weekly Analysis and Outlook for Traders

GBP/JPY continues its upward trend, reaching as high as 202.01 after a brief retreat. The initial bias for this week is on the upside,...

Weekly Trading Forecast: Key Events and Releases to Monitor

Stay informed about the upcoming economic events and speeches that could impact the financial markets this week. On Monday, June 24, at 3 AM...

EUR/USD Forecast: Lower Trading Expected Ahead of US Core PCE and French Election –...

The Euro is facing pressure this week due to dovish signals from major European central banks and concerns about fiscal and political developments in...

Gold Price Drops Following Release of Strong US PMI Data

Gold prices took a hit after the release of strong US PMI data, which showed that both manufacturing and services activity remained robust in...

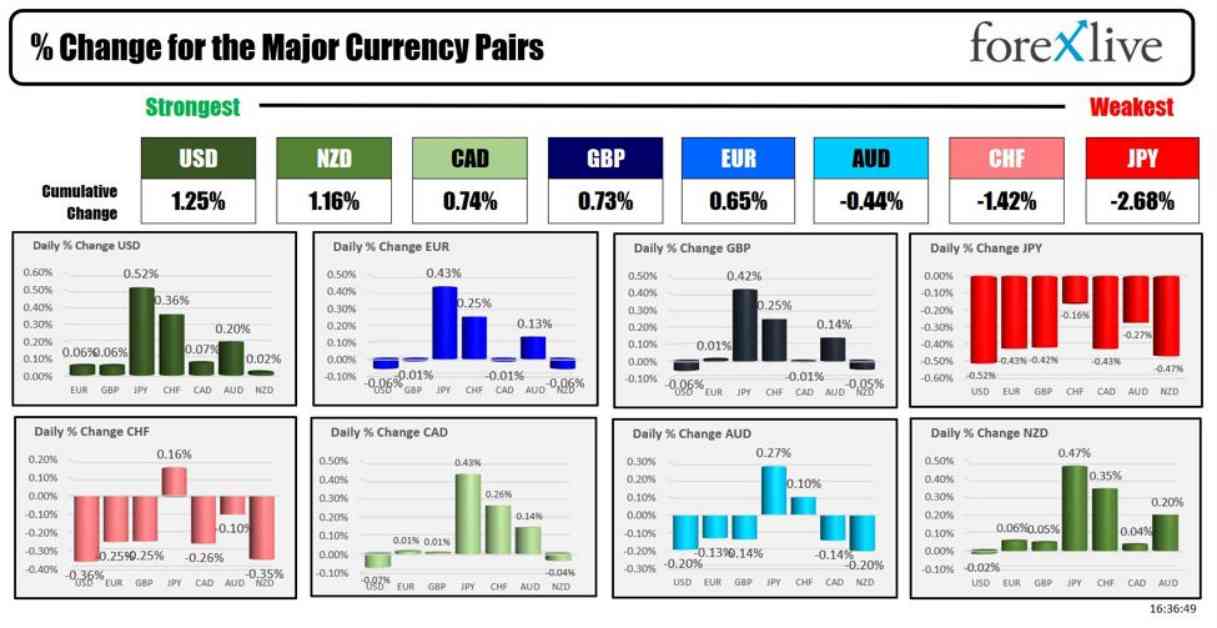

Forexlive Americas FX News Wrap: USD Rises on Strong Flash S&P Data | 21...

The week ended on a soft note for US equities, with key events and releases to watch in the upcoming week. Gold saw a...

USD Strengthens following Recent European Central Bank Activities – ING

The Dollar gained strength due to recent activities by the European Central Bank, according to FX Strategist Francesco Pesole from ING. This was influenced...

BoE August Rate Cut Increases, EUR/GBP Recovery Delayed

Thursday's statement from the Bank of England (BoE) indicates that there may be an interest rate cut coming soon, according to ING's FX Strategist...

Euro Area Recovery in Question as PMIs Highlight Weakness

The Euro Area's economic recovery is facing uncertainty as recent Purchasing Managers' Index (PMI) data points to weaknesses in the region. While global equities...

US Equities End Week on Soft Note: Market Analysis | Forexlive

Foreign exchange trading is a risky endeavor that may not be suitable for all investors. It is important to carefully consider your investment objectives,...

USD/NOK Rises as Norges Bank Maintains Hawkish Stance

The Norges Bank made the expected decision to keep its interest rate steady at 4.5%, postponing any rate cuts until the first quarter of...